Debit & Credit Rules for Basic Accounting Elements

Table of Content:

🔹 Debit & Credit Rules for Basic Accounting Elements

1. Assets (Things the business owns)

-

Rule:

-

Debit what comes in

-

Credit what goes out

-

✅ Example:

-

Business buys machinery for $10,000 (Cash paid).

-

Machinery A/c Dr. $10,000 (comes in)

-

Cash A/c Cr. $10,000 (goes out)

-

2. Liabilities (What the business owes)

-

Rule:

-

Debit decrease in liability

-

Credit increase in liability

-

✅ Example:

-

Business takes a loan of $5,000 from bank.

-

Bank Loan A/c Cr. $5,000 (liability increases)

-

Cash A/c Dr. $5,000 (asset increases)

-

3. Equity (Capital / Owner’s Equity)

-

Rule:

-

Debit decrease in capital

-

Credit increase in capital

-

✅ Example:

-

Owner invests $20,000 cash in business.

-

Cash A/c Dr. $20,000 (asset increases)

-

Capital A/c Cr. $20,000 (owner’s equity increases)

-

4. Revenue / Income

-

Rule:

-

Debit decrease in income

-

Credit increase in income

-

✅ Example:

-

Business earns $2,000 service income (on cash).

-

Cash A/c Dr. $2,000 (asset increases)

-

Service Revenue A/c Cr. $2,000 (income increases)

-

5. Expenses / Losses

-

Rule:

-

Debit all expenses & losses

-

Credit all incomes & gains

-

✅ Example:

-

Paid $1,000 as office rent.

-

Rent Expense A/c Dr. $1,000 (expense increases)

-

Cash A/c Cr. $1,000 (asset decreases)

-

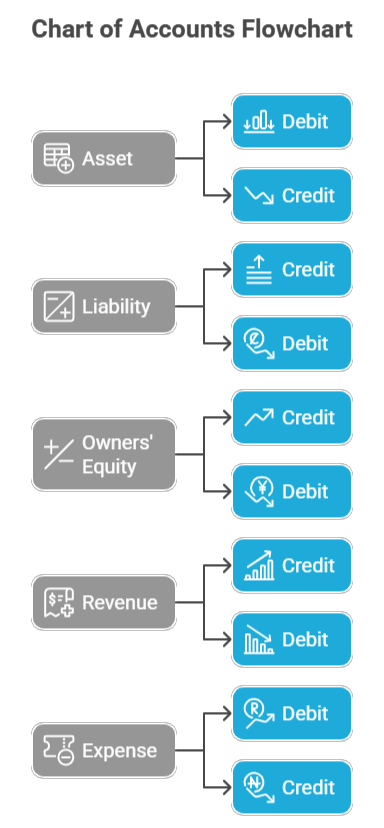

🔹 Quick Memory Table

| Element | Debit (Dr.) | Credit (Cr.) |

|---|---|---|

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity (Capital) | Decrease | Increase |

| Revenue/Income | Decrease | Increase |

| Expenses/Losses | Increase | Decrease |

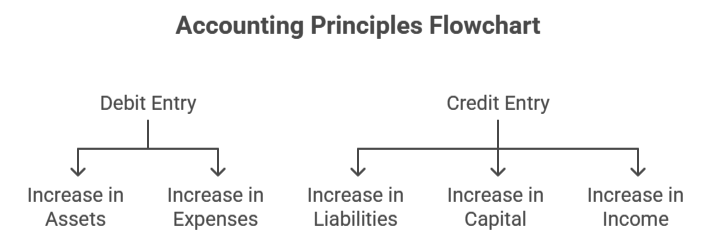

✅ In short:

-

Debit = Assets ↑, Expenses ↑

-

Credit = Liabilities ↑, Capital ↑, Income ↑